James Harris Simons, known affectionately as Jim, was not merely a man but a force of intellectual curiosity, philanthropy, and innovation. His passing on May 10, 2024, marks the end of an era, leaving behind a legacy that reverberates through mathematics, finance, and philanthropy.

Table of Contents

Born in 1938, Jim’s journey began as a mathematician, a field where his brilliance shone early. He earned his Ph.D. at the age of 23 from the University of California, Berkeley, under the guidance of the eminent mathematician Bertram Kostant. This early academic success laid the groundwork for a career that would blend academia, finance, and philanthropy in unprecedented ways.

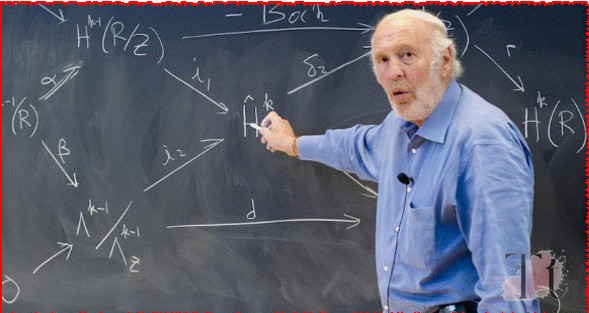

Jim’s contributions to mathematics are manifold. During his tenure at Stony Brook University, he chaired the mathematics department, leaving an indelible mark on the institution and the field itself. His research spanned diverse areas such as geometry, topology, and theoretical physics, with his work in geometry and topology proving particularly influential. Concepts he developed, such as the Chern-Simons form and the Chern-Simons theory, have become cornerstones in these fields, shaping the trajectory of modern mathematics.

However, Jim’s impact extended far beyond the confines of academia. In 1978, he founded Renaissance Technologies, a hedge fund that pioneered quantitative trading strategies. Under his leadership, Renaissance Technologies became a titan in the world of finance, achieving unparalleled success and revolutionizing the way markets are understood and traded.

Yet, Jim’s vision transcended mere financial gain. With his wife Marilyn, he embarked on a philanthropic journey that would redefine the landscape of scientific research and education. In 1994, they established the Simons Foundation, a testament to their commitment to advancing the frontiers of knowledge in mathematics and the basic sciences. Through the foundation, they provided substantial support to scientists and organizations worldwide, catalyzing breakthroughs in fields as diverse as autism research, cosmology, cellular biology, and computational science.

Jim’s philanthropic ethos was guided by a deep-seated belief in the transformative power of education and research. He recognized the importance of nurturing the next generation of scientists and mathematicians, particularly in an era marked by increasing specialization and complexity. Initiatives such as Math for America, which seeks to improve mathematics education in the United States, underscored his commitment to fostering excellence and innovation in STEM fields.

Throughout his life, Jim remained steadfast in his pursuit of knowledge and his desire to make a meaningful difference in the world. His legacy is not only measured in dollars or academic accolades but in the countless lives he touched and the boundaries he pushed. Whether as a mathematician, investor, or philanthropist, Jim Simons’ impact will endure for generations to come, a testament to the power of intellect, compassion, and vision.

The Legacy of Jim Simons: Mathematician, Investor, and Philanthropist

The passing of Jim Simons, the renowned mathematician-turned-investor, marks the end of an era in the world of finance and quantitative analysis. Simons, who founded Renaissance Technologies, a secretive hedge fund based in East Setauket, New York, was widely regarded as one of the most successful and enigmatic figures in the investment world. His remarkable ability to generate consistently high returns, particularly through his flagship fund, Medallion, earned him the nickname “Quant King.”

Born on April 25, 1938, in Brookline, Massachusetts, Jim Simons exhibited a prodigious talent for mathematics from a young age. After completing high school in just three years, he pursued his undergraduate studies at the Massachusetts Institute of Technology (MIT), where he earned a bachelor’s degree in mathematics in 1958. His academic journey continued at the University of California, Berkeley, where he embarked on his Ph.D. studies while also exploring his burgeoning interest in investing.

Simons’ foray into the world of finance began during his time at Berkeley when he started trading soybean futures at a Merrill Lynch brokerage in San Francisco. However, it was his transition to a high-paying and classified position at the Institute for Defense Analyses in Princeton, New Jersey, in 1964 that marked a pivotal moment in his career. Tasked with supporting the US National Security Agency in cracking codes and ciphers used by the Soviet Union during the Cold War, Simons honed his analytical skills and developed a keen understanding of the power of data analysis—a skill that would later become central to his investment strategy.

After his tenure in government service, Simons delved deeper into academia, holding positions at Harvard University and ultimately becoming the chairman of the mathematics department at Stony Brook University in New York. It was during this period that he made significant contributions to mathematics, particularly in the fields of geometry, topology, and theoretical physics. His research laid the groundwork for groundbreaking concepts such as the Chern-Simons form and the Chern-Simons theory, which have since become indispensable tools in modern mathematics.

However, it was Simons’ transition from academia to finance in his 40s that would cement his legacy as one of the greatest investors of his time. Rejecting traditional investment strategies in favor of quantitative analysis, Simons founded Renaissance Technologies—a firm that would become synonymous with cutting-edge technology and unparalleled returns. At Renaissance, Simons assembled a team of mathematicians, scientists, and code breakers, leveraging their expertise to extract valuable insights from vast amounts of data.

One of the hallmarks of Simons’ approach was his emphasis on data-driven decision-making. Renaissance’s proprietary algorithms scoured terabytes of data daily, ranging from financial markets to obscure phenomena like sunspots and overseas weather patterns. By identifying patterns and correlations in these datasets, Renaissance was able to generate outsized returns, consistently outperforming the broader market indices.

Despite his immense success, Simons remained notoriously secretive about the inner workings of Renaissance and the strategies employed by his firm. The precise methods behind Medallion’s extraordinary returns remained closely guarded secrets, leading to speculation and fascination among investors and industry observers alike.

Jim Simons’ impact extended far beyond the realm of finance. Through his philanthropic endeavors, particularly the establishment of the Simons Foundation, he sought to advance scientific research and education, supporting initiatives aimed at nurturing the next generation of mathematicians and scientists. His dedication to intellectual pursuits, coupled with his entrepreneurial spirit and philanthropic generosity, leaves behind a legacy that will continue to inspire generations to come.

Jim Simons: The Mathematical Mind Behind Wall Street’s Success

The recent passing of Jim Simons marks the end of an era in both the world of mathematics and finance. A pioneer in quantitative investing, Simons rose from his academic roots to become one of the most successful and enigmatic figures on Wall Street. His remarkable journey, marked by groundbreaking mathematical insights and unparalleled investment returns, has left an indelible mark on both academia and finance.

Born on April 25, 1938, in Brookline, Massachusetts, Jim Simons exhibited an early aptitude for mathematics. After completing his undergraduate studies at the Massachusetts Institute of Technology (MIT), where he earned a bachelor’s degree in mathematics in 1958, Simons continued his academic pursuits at the University of California, Berkeley, where he obtained his Ph.D. in mathematics at the remarkably young age of 23. This early academic success foreshadowed the extraordinary career that lay ahead.

During the Vietnam War, Simons lent his mathematical talents to the service of his country, working as a codebreaker for U.S. intelligence. His ability to decipher complex codes and monitor Soviet communications demonstrated his proficiency not only in mathematics but also in applying mathematical principles to real-world problems—a skill that would prove invaluable in his later endeavors.

In 1978, at the age of 40, Simons made the bold decision to transition from academia to finance, founding what would later become Renaissance Technologies. Rejecting traditional investment strategies based on fundamental analysis, Simons pioneered the use of mathematical models and algorithms to drive investment decisions. This approach, known as quantitative investing, revolutionized the world of finance and laid the groundwork for Renaissance’s unprecedented success.

At Renaissance, Simons assembled a team of mathematicians, scientists, and code breakers, harnessing their collective expertise to develop sophisticated trading algorithms. These algorithms, fueled by vast amounts of data and advanced computing power, enabled Renaissance to identify market inefficiencies and exploit trading patterns with remarkable precision. The result was the creation of the Medallion Fund, Renaissance’s flagship investment vehicle, which delivered astonishing average annual returns of 66% between 1988 and 2018—a feat unmatched by any other hedge fund in history.

Simons’ approach to investing was characterized by his unwavering reliance on technology and data-driven decision-making. Unlike traditional investors who relied on subjective analysis of company fundamentals, Simons entrusted the decision-making process entirely to automated trading systems, allowing the algorithms to dictate investment strategies based on mathematical patterns and market trends. This hands-off approach, combined with Renaissance’s proprietary technology, proved to be a winning formula, propelling Simons and his firm to the pinnacle of success on Wall Street.

Despite his towering achievements in finance, Simons remained deeply rooted in his academic background. As a former chair of the mathematics department at Stony Brook University in New York, Simons continued to make significant contributions to the field of mathematics throughout his career. His research in areas such as string theory, topology, and condensed matter physics laid the foundation for groundbreaking mathematical concepts that continue to shape our understanding of the universe.

Simons’ influence extended far beyond the realm of finance and academia. Together with his wife, he established the Simons Foundation in 1994, a philanthropic organization dedicated to supporting mathematics and science research. Through their generous contributions, the Simons Foundation has funded countless research projects and initiatives aimed at advancing scientific knowledge and nurturing the next generation of mathematicians and scientists.

In the wake of Jim Simons’ passing, the world has lost not only a visionary mathematician and investor but also a philanthropist whose impact will be felt for generations to come. His legacy serves as a testament to the transformative power of mathematics and technology in shaping the future of finance and scientific discovery. As we reflect on his remarkable life and accomplishments, we are reminded of the enduring legacy of a true pioneer whose contributions have forever changed the landscape of mathematics, finance, and philanthropy.

Read more about Akshaya Tritiya 2024: Blissful Occasion and Joyful Wishes

1 thought on “Jim Simons-2024:Quant Genius and Visionary Philanthropist”