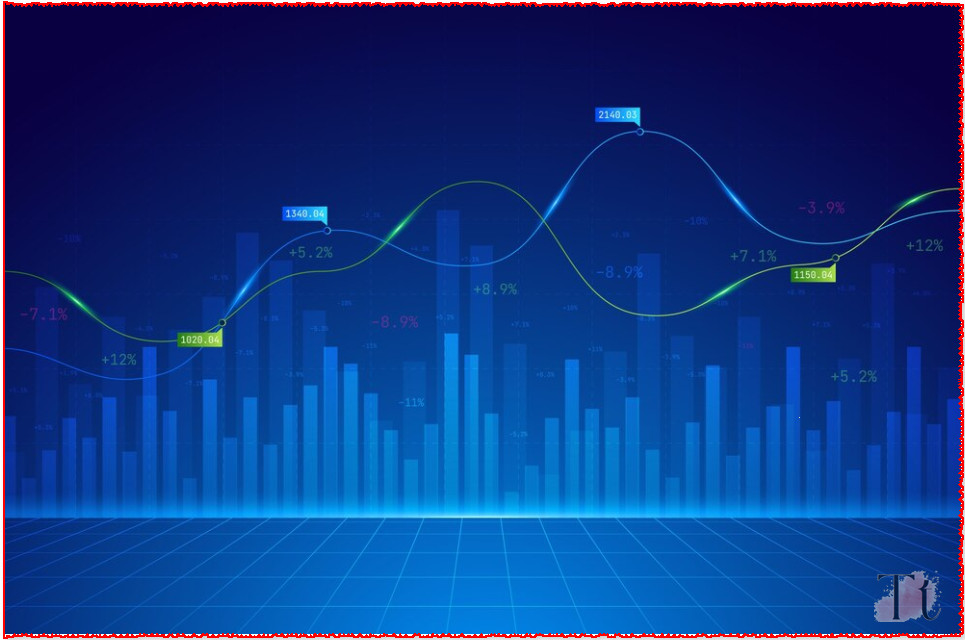

Today, Indian Railway Finance Corporation (IRFC) saw a positive uptick in its stock price, rising by 2.63%. It closed at Rs. 158.05 per share and is currently trading at Rs. 162.2 per share. Investors are advised to keep a close eye on IRFC’s stock in the upcoming days and weeks to gauge its reaction to market trends.

Taking a closer look at today’s performance, IRFC’s stock opened at Rs. 151.25, peaked at Rs. 159, and hit a low of Rs. 149.65 before settling at Rs. 150.25. The market capitalization for Indian Railway Finance Corporation currently stands at Rs. 206,547.74 crore. Over the past year, the stock has seen a high of Rs. 192.8 and a low of Rs. 27.93.

Table of Contents

In terms of trading volume on the Bombay Stock Exchange (BSE), there were 15,784,505 shares exchanged today.

It’s important to note that this information comes with a disclaimer: it’s an AI-generated live blog and hasn’t been edited by LiveMint staff.

Indian Railway Finance Corporation Shares Surge: A Railway to Riches Amidst Market Contrasts

Certainly! Let’s break down the information about the Indian Railway Finance Corporation (IRFC) share price and its performance compared to the broader market index, Nifty, in a more detailed and accessible manner:

Indian Railway Finance Corporation, which is involved in financing railway projects in India, has seen its share price rise significantly. Currently, each share of IRFC is valued at ₹163.20, marking a notable increase of 3.26% from its previous value.

To put this growth into perspective, let’s look back over the past year. In that time frame, the value of IRFC shares has skyrocketed by an impressive 402.54%. This means that if you had invested in IRFC shares a year ago, you would now see a remarkable return on your investment due to this substantial increase in share price.

Comparing this performance to the broader market index, Nifty, we find an interesting contrast. While Indian Railways Finance Corporation shares have surged by over 400%, the Nifty index has experienced a more modest increase of 24.11% during the same one-year period. Nifty, which represents a basket of top-performing stocks on the National Stock Exchange of India, has risen to 22419.95 points.

So, what’s driving this exceptional growth in IRFC’s share price? Several factors could be contributing to this surge. It’s possible that investors have recognized the potential for growth and profitability in IRFC, especially considering its involvement in financing crucial railway projects in India. Additionally, favorable market conditions, government policies supporting infrastructure development, and the company’s financial performance may all be influencing investor sentiment towards IRFC.

Overall, the significant rise in IRFC’s share price compared to the broader market index like Nifty suggests that investors see promising opportunities in the company’s future prospects. However, as with any investment, it’s essential to conduct thorough research and consider various factors before making any investment decisions. give a unique heading for this content

IRFC Shares: Volume Dips, Bullish Outlook Prevails

Yesterday’s trading session for Indian Railway Finance Corporation (IRFC) saw a notable decrease in trading volume compared to the average over the past 20 days. While the typical trading volume stands at around 58068 thousand shares, yesterday’s volume was substantially lower at 47 million shares, marking a decrease of approximately 17.55%.

Breaking down the volume further, it’s worth noting that on the National Stock Exchange (NSE), the volume stood at 44 million shares, while on the Bombay Stock Exchange (BSE), it was 3 million shares.

Despite the lower trading volume, IRFC’s share price closed at ₹150.25 at the end of the trading day. This price movement indicates a bullish trend in the near term, according to technical analysis.

During yesterday’s trading session, Indian Railways Finance Corporation shares fluctuated within a range of ₹159 to ₹149.65 before settling at ₹150.25. This strong bullish trend suggests that investors are optimistic about IRFC’s future performance and potential for growth.

Overall, while trading volume dipped, IRFC’s bullish outlook remains intact, with investors showing confidence in the stock’s upward trajectory.

Full Steam Ahead: Why IRFC Could Steer Your Portfolio to Success

As the stock markets kicked off with vigor on Monday, April 29th, there was a buzz surrounding Railway PSU shares. Motilal Oswal, a renowned brokerage firm, singled out Indian Railway Finance Corporation (IRFC) as a short-term technical pick for trading over 2-3 days.

IRFC shares have been on a winning streak, marking their fifth consecutive session of gains. Closing at ₹158.05 on Friday, they surged by a notable 5.19% in a single day. Impressively, the stock has soared by nearly 12% throughout the week, adding to its multibagger status. Over the past six months, it has recorded an impressive gain of around 120%, and an astounding 402% over the year.

The trading volume for Indian Railways Finance Corporation”Indian Railway Finance Corporation Stock Surges: Investors Alert Amidst Vigorous Resilient Market Momentum””Indian Railway Finance Corporation Stock Surges: Investors Alert Amidst Vigorous Resilient Market Momentum” on the Bombay Stock Exchange (BSE) surged significantly, with approximately 1.58 crore shares changing hands, far exceeding the two-week average volume of 42.93 lakh shares. This heightened trading activity translated into a turnover of Rs 246 crore, amplifying the company’s market capitalization to Rs 2,06,547.74 crore.

Analyzing the technical setup, experts suggest that the stock has strong support at the Rs 152-150 range. However, to propel further upside, a decisive close above the Rs 160 level is deemed necessary in the near term.

According to Ravi Singh, Senior Vice-President at Religare Broking, IRFC exhibits strength on daily charts, potentially targeting Rs 175 in the near future, with a suggested stop loss at Rs 152.

Jigar S Patel, Senior Manager at Anand Rathi Shares and Stock Brokers, predicts a support level at Rs 150 and resistance at Rs 160, with further upside potential till Rs 170 upon a decisive close above Rs 160.

On the technical front, IRFC’s trading surpassed various moving averages, indicating bullish momentum. The stock’s 14-day Relative Strength Index (RSI) stood at 51.58, suggesting a balanced sentiment.

IRFC’s core business involves borrowing funds from financial markets to finance assets leased out to Indian Railways or entities under the Ministry of Railways. As of March 2024, promoters hold an 86.36% stake in this ‘Navratna’ PSU.

Disclaimer: This analysis provided by Business Today aims to offer stock market insights and should not be considered as investment advice. It’s advisable for readers to seek guidance from a qualified financial advisor before making investment decisions.

Railway Stocks: A Track to Success

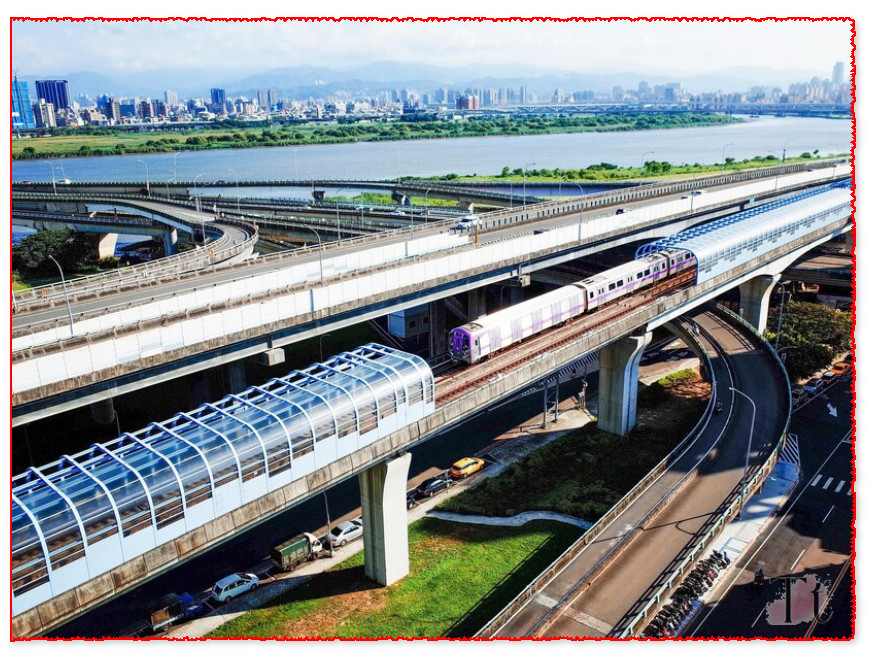

India’s extensive railway network, spanning over 126,000 km and serving 7,335 stations, is the backbone of the nation’s transportation system. Recognizing the need to modernize and expand this vital infrastructure, the Indian government has earmarked a staggering Rs 1 trillion investment for procuring new train sets, laying fresh tracks, and enhancing overall rail infrastructure across the country.

Amidst this ambitious plan, two companies stand out as prime beneficiaries: Rail Vikas Nigam Limited (RVNL) and Indian Railways Finance Corporation (IRFC).

RVNL, established in 2003, plays a crucial role in bridging the infrastructure gap within Indian Railways. Specializing in project development from inception to completion, RVNL spearheads various initiatives such as doubling of tracks, gauge conversion, railway electrification, and construction of major bridges. Its exceptional track record includes contributing significantly to railway doubling and electrification projects, showcasing its prowess in executing projects efficiently.

With an impressive order book of Rs 650 billion as of December 2023, RVNL enjoys robust revenue visibility in the medium term. Moreover, its diversification into sectors like road, irrigation, and mass rapid transport projects, along with international expansion plans, further solidifies its position in the market.

On the other hand, IRFC, established in 1986, serves as the financial backbone of the Ministry of Railways. Registered as a systemically important non-banking financial company (NBFC) with the Reserve Bank of India, IRFC’s primary business involves borrowing funds from financial markets to finance railway projects and acquisitions, subsequently leasing them out to Indian Railways.

In terms of market capitalization, IRFC dwarfs RVNL, underscoring its significant presence in the sector. Furthermore, when comparing stock performance, IRFC has outpaced RVNL and the Nifty 50 benchmark index. Over the past year, IRFC’s shares have surged by over 400%, showcasing remarkable growth compared to RVNL’s 179% and Nifty 50’s 26% returns.

In essence, both RVNL and IRFC play integral roles in driving India’s railway infrastructure forward. While RVNL focuses on project execution and diversification, IRFC serves as the financial backbone, fueling the funding needs of Indian Railways. As these companies continue to contribute to the nation’s railway development, investors may find promising opportunities in their growth trajectories.

CONCLUSION

Embarking on the Railway Stocks Journey: Exploring RVNL and IRFC

In the bustling landscape of railway stocks, two formidable entities rise to prominence: Rail Vikas Nigam Limited (RVNL) and Indian Railways Finance Corporation (IRFC). These titans hold pivotal roles in India’s ambitious endeavors to modernize and enhance its extensive rail network, which serves as the lifeline of the nation’s transportation infrastructure.

RVNL emerges as a powerhouse in infrastructure development, spearheading crucial projects such as laying new tracks, electrifying railways, and constructing vital bridges. With a track record of successful project completion and a diversified portfolio that extends beyond railways to encompass various infrastructure ventures, RVNL stands poised for sustained growth and expansion.

On the other hand, IRFC assumes the critical role of the financial backbone, facilitating the procurement of funds for railway projects and leasing them to Indian Railways. Its towering market capitalization and impressive stock performance underscore its significance in fueling the advancement of railway infrastructure across the nation.

As investors navigate the landscape of railway stocks, they are presented with a compelling dichotomy between RVNL and IRFC, each offering distinct strengths and opportunities. Whether prioritizing investment in project execution prowess embodied by RVNL or seeking the stability and growth potential offered by IRFC’s financial prowess, investors are presented with a spectrum of possibilities to align with their investment objectives.

In essence, both RVNL and IRFC symbolize integral components of India’s journey towards a modernized and robust rail network. By carefully evaluating the contrasting strengths and opportunities presented by these titans and strategically aligning their investments, investors can embark on a journey aboard the railway stocks train, poised to navigate towards potential success in tandem with India’s evolving rail infrastructure landscape.